The shadow economy in Latvia continues to decline

13.06.2025

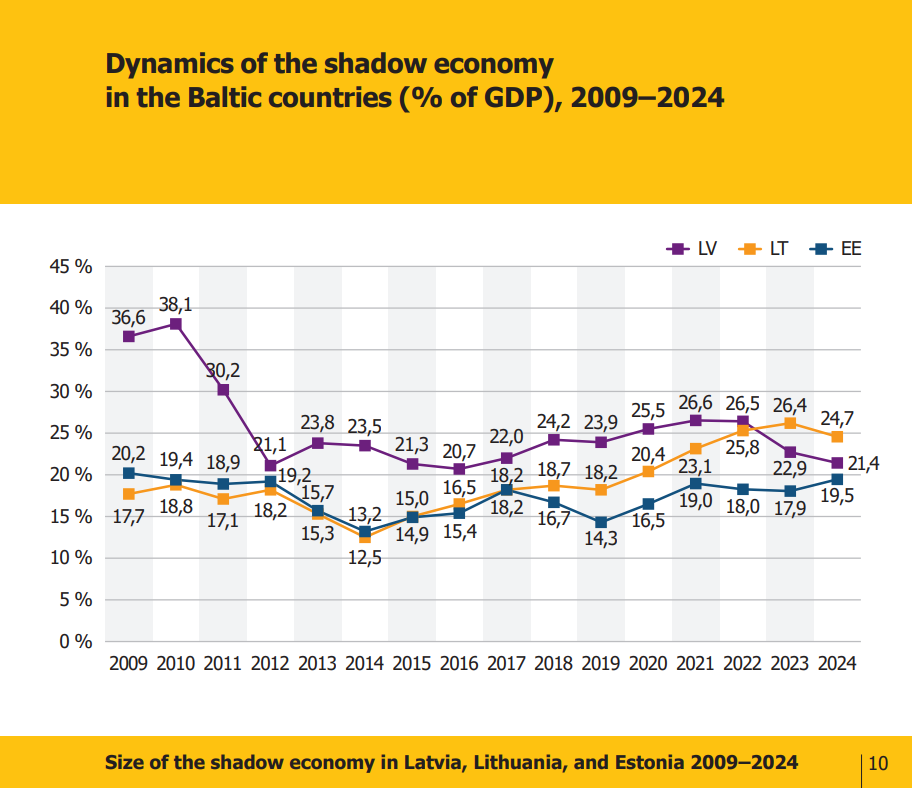

According to the latest data from the Stockholm School of Economics in Riga (SSE Riga) “Shadow Economy Index in the Baltic States”, presented today during the annual Shadow Economy Conference, the size of the shadow economy in Latvia has continued to decrease in 2024, reaching 21.4% of gross domestic product (GDP). This is 1.5 percentage points less compared to 2023. A decrease in the shadow economy in 2024 is also observed in Lithuania – minus 1.7 percentage points, compared to 2023, reaching 24.7% of GDP. In Estonia, the shadow economy has increased to 19.5% of GDP in 2024, which is 1.6 percentage points more than a year earlier.

The shadow economy index has been calculated in the Baltic States since 2009. According to the latest data, in 2024 the highest level of shadow economy among the Baltic States was in Lithuania. Although Estonia still has a lower shadow economy than Latvia and Lithuania, in 2024 Estonia recorded the highest indicator since the start of shadow economy measurements in the Baltic States.

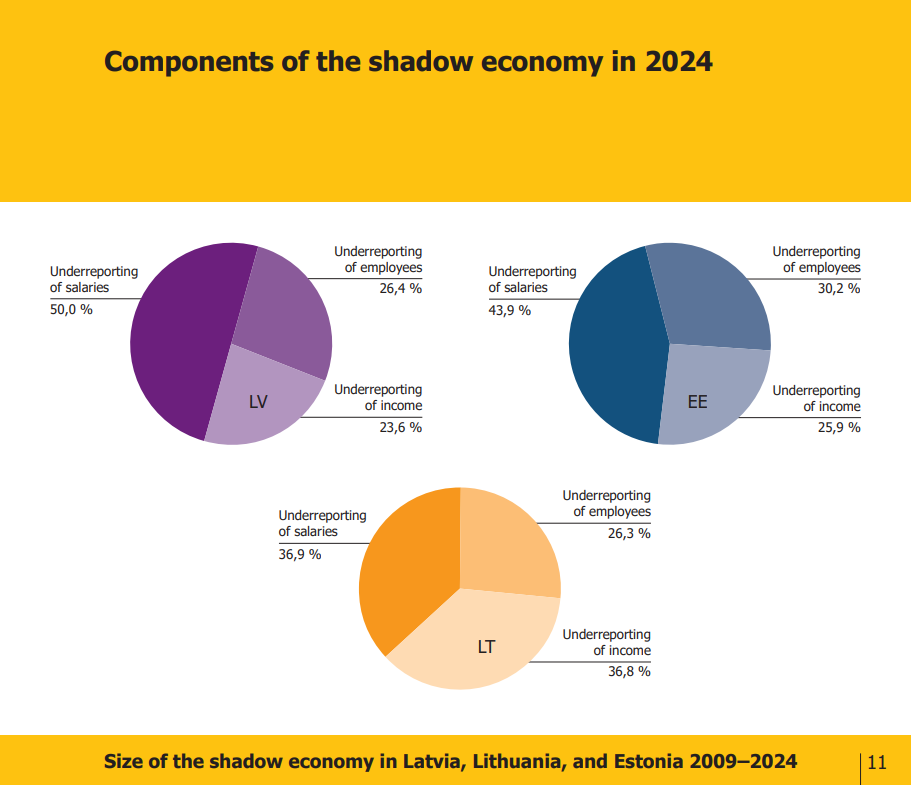

As the author of the study, SSE Riga professor Dr. Arnis Sauka, points out: “The results of the study show that in 2024, the most significant component of the shadow economy in Latvia, Estonia and Lithuania was envelope wages. Therefore, policymakers should continue to actively seek solutions that would promote a decrease in the volume of envelope wages – especially through voluntary means, not only through fines and sanctions. One way to achieve this is to demonstrate good practice in more efficient use of taxpayers’ money. This, among other things, is related to the ability to reduce expenses and overall bureaucracy in public administration. Such practice would contribute to the increase in tax morale among entrepreneurs – an attitude where taxes are paid, even if there is an opportunity not to do so. Tax morale cannot be improved with laws alone, but it has a major impact on reducing the volume of the shadow economy.”

According to the latest research results, in Latvia, envelope wages accounted for 50.0% of the total shadow economy, in Estonia – 43.9%, and in Lithuania – 36.9%. Unreported income in Latvia in 2024 amounted to 24.6% of the total shadow economy, while the component of undeclared employees – 27.4%. Unreported employees in Estonia in 2024 amounted to 30.2% of the total shadow economy, while undeclared income – 25.9%. In turn, in Lithuania, undeclared income in 2024 amounted to 36.8% of the total shadow economy, while the component of undeclared employees – 26.3%.

n 2004, compared to 2023, both Latvia and Lithuania saw a decrease in the share of average wages (%) that entrepreneurs hide from the state, or envelope wages. Namely, in Latvia, envelope wages decreased by 2.9 percentage points and reached 20.7%, but in Lithuania – by 2.7 percentage points, reaching 18.1%. In Estonia, however, envelope wages increased to 17.2% in 2024, which is 0.7 percentage points more compared to 2023.

In the area of income (profit) understatement, in 2024, compared to 2023, an increase was observed in all three Baltic countries, but the largest in Estonia, where it increased from 9.5% to 12.1% (+2.6 percentage points). However, Estonia still has the lowest level of profit understatement among the Baltic countries. It is highest in Lithuania – 20.5% in 2024, which is +0.9 percentage points more compared to 2023. In Latvia, profit underreporting increased by 0.6 percentage points in 2024 and reached 15.2%.

According to the latest data from the Shadow Economy Index, in 2024, compared to 2023, a decrease in the volume of employee underreporting was observed in all three Baltic countries. Namely, in Latvia, employee underreporting (the average % of the total number of employees employed without a contract) reached 10.9% in 2024 (-0.8 percentage points, compared to 2023), in Lithuania – 11.7% (-3.7 percentage points), and in Estonia – 10.6% (-0.1 percentage points).

As Dr. emphasizes Arnis Sauka: “We also asked respondents the question: “What would be the consequences if a company in your industry were caught providing false figures?” 5.1% of respondents in Latvia, 6.0% in Lithuania and 9.4% in Estonia answered “nothing serious”. 35.2% of respondents in Latvia, 40.0% in Lithuania and 30.2% in Estonia answered this question with “a serious fine that would affect the company’s competitiveness”. In turn, 20.4% of Latvian, 12.4% in Lithuania and 17.6% in Estonia answered “the company would be forced to cease its operations”.

The latest results of the SSE Riga “Shadow Economy Index in the Baltic States” also show that the overall bribery level (the percentage of income that companies pay in unofficial payments to “get things done”) in Latvia decreased from 10.0% in 2023 to 9.3% in 2024, or by 0.7 percentage points. In turn, an increase in the overall bribery level is observed in Estonia (by 0.8 percentage points) and in Lithuania (by 2.4 percentage points), reaching 7.0% and 10.5% respectively. The results of the study also show that in all Baltic countries in 2024, compared to 2023, the average % of the contract amount to secure a government order has increased. A particularly pronounced increase is observed in Estonia, where the average % of the contract amount to secure a government order has increased from 3.3% in 2023 to 7.4% in 2024 (by 4.1 percentage points or more than twice). In Latvia, this component has increased by 0.3 percentage points, reaching 7.8% in 2024, but in Lithuania – by 2.0 percentage points, to 9.9%.

The highest level of the shadow economy in Latvia in 2024 is observed in Kurzeme (24.2%), followed by Latgale (22.7%), Vidzeme (22.2%), Riga region (21.2%) and Zemgale (18.0%).

In terms of sectors, the highest share of the shadow economy in Latvia is still in the construction sector – 33.8% (-0.4 percentage points, compared to 2023). In 2024, the shadow economy in Latvia reached 26.2% in retail trade (27.0% in 2023), in the service sector – 23.6% (26.4% in 2023), in manufacturing – 17.3% (18.9% in 2023), and in wholesale trade – 13.0% (13.0% in 2023).

Regarding attitude, companies in the Baltic States are still relatively satisfied with the activities of the State Revenue Service (SRS), which, according to the latest data, is rated slightly higher in Lithuania. Namely, on a scale from 1 to 5, where 5 means very high satisfaction, in 2024, satisfaction with the SRS in Latvia increased to 3.60 (3.47 in 2023), and the same rating was also obtained in Estonia – which is a decrease from 3.76 in 2023. In Lithuania, on the other hand, in 2024, entrepreneurs’ satisfaction with the SRS was rated at 3.72 (3.75 in 2023).

The results of the study show that in 2024, compared to 2023, entrepreneurs’ satisfaction with the state’s tax policy has improved in Latvia and Lithuania. Namely, on a scale from 1 to 5, the rating has increased from 2.60 in 2023 to 2.65 in 2024 in Latvia. The same indicator has improved from 2.84 to 3.09 in Lithuania. In turn, Estonia has the lowest business satisfaction with tax policy among the Baltic countries – it has decreased from 2.58 in 2023 to 2.12.

In 2024, compared to 2023, Estonian business satisfaction with the quality of business legislation has also decreased – from 3.20 to 2.93. According to the latest research results, business satisfaction with the quality of business legislation has slightly increased in Latvia: from 3.04 in 2023 to 3.06 in 2024; in Lithuania – from 2.95 to 3.00. In turn, satisfaction with government support for entrepreneurs in Latvia in 2024, compared to 2023, has decreased to 2.52 (2.57 in 2023), in Estonia – to 2.32 (2.43 in 2023), but in Lithuania it has increased slightly – the rating is 2.79 (2.77 in 2023).

As the author of the study, SSE Riga professor Dr. Arnis Sauka points out: “The shadow economy in Latvia continues to decline, which is certainly a good thing. At least in part, this could be the result of the state administration’s efforts to reduce the shadow economy by implementing the activities of the shadow economy combat plan. However, the shadow economy is declining slowly, which raises the question – are there any actions possible to reduce the shadow economy more rapidly in the country? And wouldn’t it be time to return to reducing the shadow economy as one of the main priorities – an issue that, it seems, has, if not disappeared from the agenda of politicians and civil servants, then at least no longer occupies a place among the main priorities in the country. This is especially important in a situation when defense spending needs to be significantly increased, while not forgetting about economic development, and when there are limited opportunities to borrow or increase the budget deficit.”

The study is published on the SSE Riga website: https://www.sseriga.edu/shadow-economy-index-baltic-countries

The study booklet is available HERE

About the SSE Riga Shadow Economy Index

The SSE Riga study “Shadow Economy Index in the Baltic States” is determined once a year using surveys of entrepreneurs in the Baltic States. The authors of the study are the Director of the SSE Riga Sustainable Business Center, Professor Dr. Arnis Sauka, and SSE Riga Professor Dr. Tālis Putniņš. To calculate the size of the shadow economy as a percentage of GDP, the index includes estimates of undeclared business income, unregistered or hidden employees, as well as undeclared “envelope” wages.

Jaunākās ziņas

10.02.2026

The cost of non-competitive Europe

EU heads of state and government will gather at the picturesque Alden Biesen castle in the east of Belgium on ...

30.01.2026

LCCI EU Project Director Līga Sičeva receives recognition from the Ministry of Foreign Affairs

As part of the events marking the 105th anniversary of Latvia’s international recognition (de jure), Foreign Minister Baiba Braže presented ...

26.01.2026

Interview with Katrīna Zariņa, Chairwoman of the Board of the Latvian Chamber of Commerce and Industry

What could be the biggest challenges for Latvian entrepreneurs this year? The parliamentary elections. Previous experience shows that election years ...